December 04, 2020

Record Retention: End of Year Cleaning

As we enter the last month of the year, we wanted to provide a checklist of what you can throw away and what you need to file away. A lot goes into the idea of Spring cleaning, but the end of a calendar year is also a good time to check on your documents.

Ever wonder when it is acceptable to toss invoices, contribution ledgers, payroll registers, timesheets, bank reconciliations, or financial statements? We can answer all of those questions today.

The Challenge: Clutter

Nonprofit organizations are often confronted with the challenges of record management and retention. It is common for convenience and limited space to drive such decisions; however, a variety of government regulations and best practices need to be considered.

Organizations have a responsibility to protect records in both the retention and destruction processes. We also suggest you seek out companies that specialize in the destruction of documents to properly shred and dispose of paper copies as well as purge electronic files from the server and backup devices.

The Go Ahead: Throw Away Now!

In general, here are some ideas of things you don’t have to hang onto, or are okay to hit that delete button. Every six months, or so, it’s a great idea to look over your stored files and see if there are any documents you don’t need anymore. Bonus: this will keep your computer storage down, too.

- Specific reports that were run for a one-time purpose. As long as the file is included in the larger report somewhere else.

- Non work related emails, such as virtually checking in with co-workers.

- Feel free to “permanently delete” any Out of Office replies, you know you get a few of those throughout the year.

You Might Also Like: Credit Card Policies – cleaning up your list and providing proper backup documentation.

The Hold On: Need to Keep!

Here are some big items you should be retaining. Keep those over zealous fingers away from the delete key or shred bin. Also, if there is a subpoena or request for documents, an audit is being done, or if there is a litigation against the organization – all destruction of documents should cease.

- Tax Exempt Letter

- Taxes

- End of Year Reports

- Audit Reports

From the Client Services Desks: In the ever-increasing digital world, how should we keep A/P files? Clients may have file cabinets full of their paper A/P files, but we want to make sure they are storing the electronic invoices/payment records on their computer where multiple contacts from the organization can have access to them. – Client Services Team Lead

The Detailed List: Records Retention

We know you are probably as detailed oriented as we are when it comes to record-keeping and filing; and that you love a good check-list. Or maybe that’s why you hired Miller Management? 🙂

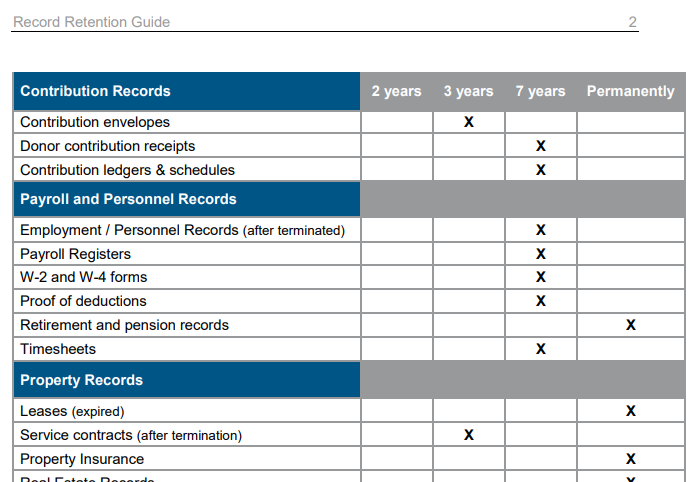

Either way, here is our complete list with 2 year, 3 year, 7 years, and Permanent increments for retention:

Record Retention Guide: click on the picture to download the PDF document.

Please note, this file is not intended to be legal advice, rather a guide. Legal advice on specific retention issues should be considered.

The Overachiever: more ways to keep the clean

Keep the Clean, or Keep the Peace – in some ways it’s all the same. As the tidying expert, Marie Kondo says, it if doesn’t “spark joy;” let it go.

After the year of lockdown most people have been in, there may not be anything else left for you to go through, but in case you have been putting it off, here are some ideas to get you started.

- Office Cleanliness: clean your space and your inbox.

- Desk Accessories: add clean air to your office space.

- Do More Better: a book review with some helpful organizational tools.

- Organizational Fun!: Miller Management’s Pinterest board of, you guessed it, organizing.

- To-Do List and Calendar: find a few more organizing tips here.

Stay Connected