August 13, 2020

National Payroll Week

For the 2024 calendar year, National Payroll Week will be happening on September 2nd – 6th. During a previous NPW, we updated this post and our social media accounts with helpful information.

Facebook | Twitter | LinkedIn

We also celebrated our Accountant and Client Services teams.

Areas of Advice

The biggest area we want to address during this week is for our clients to have their employees perform a Tax Withholding check up – with the IRS Tax Estimator – to make sure they are having the correct tax withheld from their paychecks.

“Always pay attention to new tax laws. They are like a moving target—changing yearly. Recent tax changes are supposed to put more money in the pockets of American taxpayers. However, if you don’t have enough taxes withheld, you may be in for an unpleasant shock at tax time.

“On the other hand, if you received a large refund last year, you may have had too much money withheld at work, in effect giving Uncle Sam an interest-free loan at your expense. To test your W-4 results and withholding levels, use the IRS Form W-4 Calculator.” – NPW

Payroll Week

New Post for #payrollweek : Commonly Misclassified Employees find the top three most commonly misclassified employees, according to our years of consulting work in churches.

Find our most up-to-date Payroll forms on our Resources page – to pair down the list, simply turn on the “Accounting / Payroll Forms” filter.

Other helpful information related to this topic can be found on our blog.

Top articles over the last two years include:

- New Overtime Rule

- Nine Things We’ve Learn About Churches

- New Product: SwipeClock

- Top 10 Reasons NOT to Use Our Services

- New Federal W-4 Form

- Direct Deposit Scam

- Hiring 101

Anti-fraud Measures

Another tip we want to pass along are anti-fraud measurers your organization should be adhering to. Some resources for action steps include our Contractor vs. Employee post, and our Best Practices for Check Signers post.

Some of the big take-aways from the above posts include having two checks signers on every check and the same person to watch for patterns. There also should be no relation between signers. It is also important to follow all payroll laws so there are not additional fees to be paid for non-compliance.

The biggest point our staff at Miller Management tries to make is around the notice of perceived opportunity, pressures, and rationalization. Anyone can succumb to fraud when there are not those safety measurers put into place. We go into more detail about the Fraud Triangle in our Anti-Fraud series or in the book, Confessions of a Church Felon.

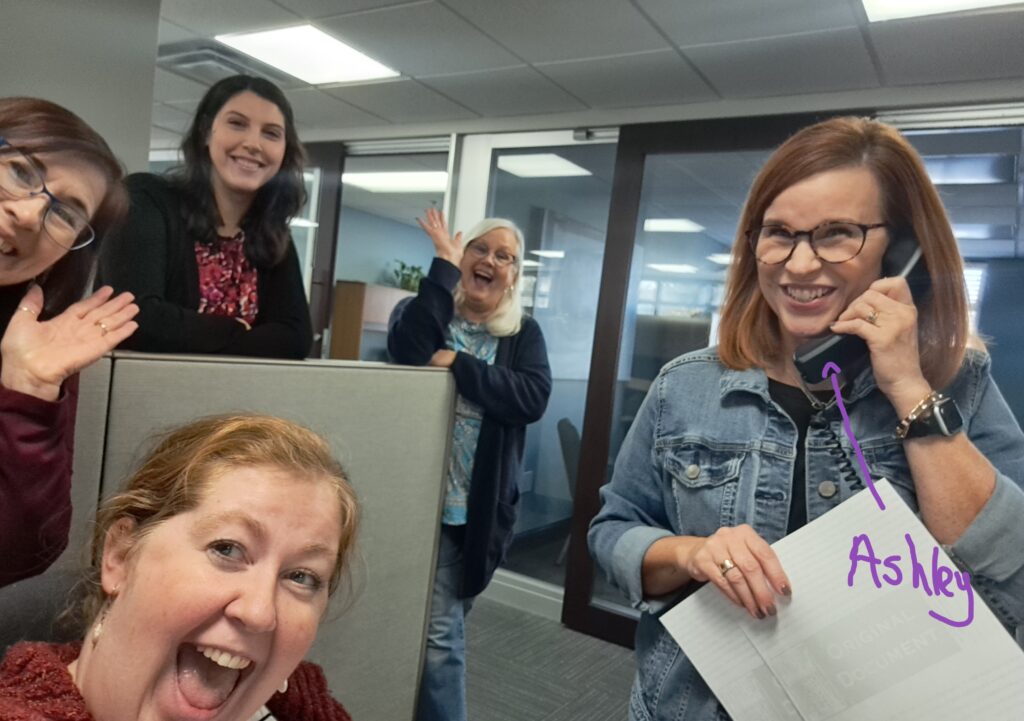

Our Team

A special thank you to our Payroll Specialists! We appreciate all they do for our clients to keep them compliant with all payroll and payroll tax laws.

MM Services

For non payroll clients, the Tax Estimator mentioned above is still a great resource. We also want you to be aware of the services that Miller Management can provide, specifically in the areas of Payroll and Payroll Taxes.

Payroll Week Sponsors

NPW is sponsored by ADP and many others. Miller Management is happy to highlight all that our Payroll Specialists do every day.

Stay Connected