April 18, 2019

Tracking Apps

Financial Literacy Month

April is Financial Literacy Month, and with that in mind, we wanted to talk a little bit about finances. Shocking, an accounting firm talking about finances … but stick with us for just a minute. 🙂

Backup Documentation:

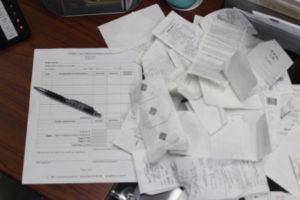

One of the things we encourage our clients to provide for EVERY check we write is backup documentation. It’s not just because we love paper and killing trees, but because the IRS requires it.

(our staff does a lot of recycling & shredding … a lot)

First, let’s talk a little bit about what not to do:

- keep most receipts and when the secretary bugs you about your credit card receipts enough times, give them all to her at once. Also trying to remember what each purchase was for, weeks later.

- keep your receipts in a nice shoe box, with every other important piece of paper you might need. And again, dump it out for someone else to sort through.

(reconciling the credit card…)

Proper Documentation:

Don’t worry if the above just described you, you are not alone. And, you are not beyond help – no matter what your spiritual gifts may be. If you are a paper-loving nerd, print out our Credit Card Reconciliation Form and get to work as soon as you get back to the office, for each transaction. If you are more adventurous, save the form to your computer and use the PDF fillable capabilities to fill out the form as you go.

Beyond the Paper:

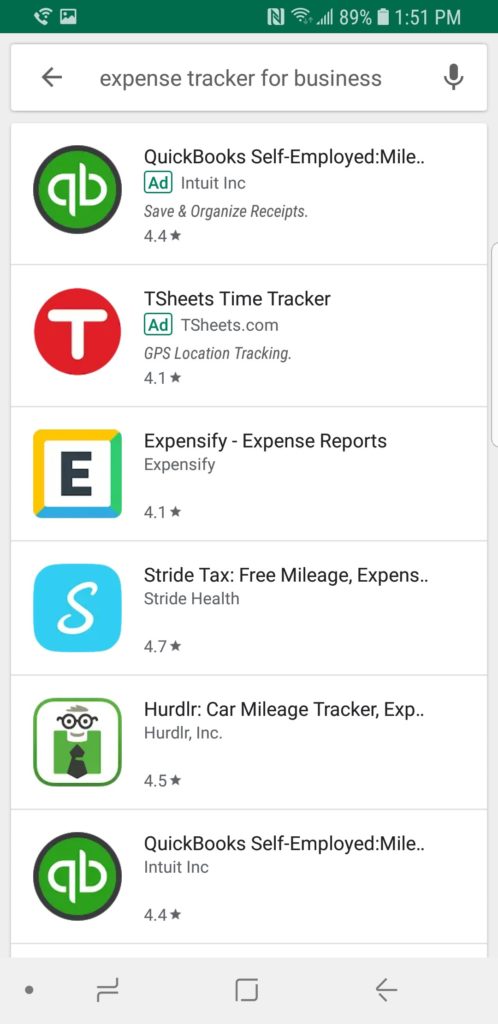

Maybe that’s not quite your speed either, or you’ve already lost the receipt by the time you get back to office. It’s hard to keep receipts, we know, things happen. But in today’s world, that’s really not an excuse anymore. (Sorry, not sorry.) Now, you can easily harness technology on your side with a tracking or receipting app. (Of course, there’s an app for that!) Below we’ve listed out a few that might help you in your paperless world.

Mileage Apps:

Mileage IQ: this app automatically records each mile driven, and you simply swipe left or right to record as business or personal.

Hurdlr: tracks all your expenses and miles and let’s you choose between business and personal. Great for entrepreneurs.

This small business site rates their favorite five mileage apps for small businesses here.

Expense Apps:

Expense It: claims to get you your reimbursement faster and increase your compliance level.

Zoho Expense: claims to expense corporate credit cards automatically.

Expensify: for those of us not born to do expenses.

Most of these applications will either let you take a picture of the receipt from your phone, or scan the document to your desktop app. Whichever way is easiest for your organization.

Disclaimer: While these apps can be a great benefit to an organization, we also know that they can get a little pricey. Miller Management’s stance would always be to do what makes the most financial sense for your organization, over some trend. If this route would benefit your organization, it is best to only purchase the features that your organization will actually use.

Personal Use:

Now, I’m sure you are all ready to not only use these apps for your business, but also for your personal use. Check out 7 free apps to help you become a money guru. Or check out a staff favorite – and Dave Ramsey recommendation – Every Dollar. This app helps you easily create a budget, ways to stick too it, and not have to stress about your budget anymore.

Happy tracking!

Stay Connected