July 08, 2020

1099’s and W-9’s: When to Use and When to Lose

“Why do we need additional paperwork for this check?” and “What are W-9’s used for?” are questions we sometimes receive during our check request process. Below you will find some information to help answer those questions.

Definitions

The first thing we need to go over is the definition of 1099 and W-9. W-9’s are the forms used for most contract work instances and should be filled out prior to work being done. A 1099 is the form the contractor receives from you at the beginning of the year that includes all payment information for the previous year.

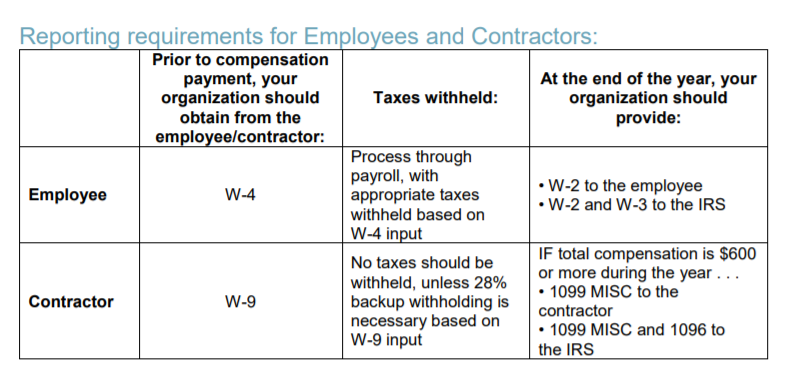

This chart, provided in our “1099 Information” white paper, provides some basic information to see what form is necessary for both an employee and a contractor.

When to Use a W-9:

Now, let’s go over a couple instances when you WILL NEED W-9’s provided.

- Unincorporated entities

- Individuals who performed work and are not hired employees

Input + Output:

The organization must issue a 1099 at the end of the year for all contract wages paid if the total amount for the year exceeds $600.00. No payments should be made until an accurate and fully completed W-9 is completed by the contractor and on file at the organization.

We want to make this a simple process, so we have provided the link to the “Federal W-9” {fillable PDF from the IRS} to send to those who should receive a 1099, and also a form letter entitled, “W-9 Request Letter” {editable word document from MM} for you to edit and send with the request. View our Resources page to find the most up-to-date forms.

Going deeper with W-9’s:

To learn more about who should receive this form, what information in needed, and also what happens if someone refuses to supply the required information, read our article entitled “1099 NEC/MISC Information.”

When to Lose a W-9:

Lastly, these instances will help you understand when to ditch the W-9’s and either use a W-4, or know when no form is needed.

- Incorporated entity, typically has an “inc.” at the end of their name

- Individuals paid as employees

- Companies you received purchased products from

- Non-employees receiving benevolence

Input + Output:

For those companies who require no extra paper work – incorporated entities or products received – nothing else is required. However, for individuals who are employees, a Form W-4 is one of the Federal forms required. Each state also has their own form, and several can be found on our MM Resources page. For any states not represented on our page, you can find your appropriate forms on your specific state’s website.

Going deeper with employees:

Behavior Control, Financial Control, and Type of Relationship are the essential factors to determine if someone is an Employee or a Contractor. We’ve listed out more information in our white paper entitled “Employee or Contractor.”

In conclusion, there are several different scenarios and this post is not meant to include them all; but, to give you some general guidelines. If you are still unclear what documentation your check needs to have, your MM representative is happy to help clarify.

Stay Connected