December 18, 2020

Offering Counting: Before the Money

During the end of the year there is usually an influx of giving to ministries and non-profits. With that in mind, we wanted to provide some tips and reminders for receiving funds and best practices for handling money.

See our End of Year Giving post for details about recording gifts correctly

It’s important to first talk about the necessary precautions to put in place before we even get to handling money. We want to set you up for success with these best practices and tips.

Before the Money

Our first tip is to utilize an Offering Counter Ministry Description and Confidentiality Agreement. We have templates for both of those items on our Resources page. Template meaning we have included what we believe you should have, but leaving room for you to include more details specific to your ministry, if necessary.

Offering counting and cash handling procedures should be in writing and should be provided with training to all offering counting team members. It’s also a good idea to include those written instructions in the counting room, so they are very accessible and easy to reference.

Receiving Money

Tip number two: now that you have your ducks in a row, let’s review some best practices for receiving the money.

- When gifts through the mail are received, there should be at least two persons available so that immediate dual controls can be established. And then placed into a safe or other secure location.

- No staff should receive money from members or guests; they should instead place their gift into a drop safe or other secure location directly.

- After money is received during a service, it should be kept under lock and key at all times. Before the Counting Team counts the money and again after the counting process, but before the bank deposit.

- The drop safe or locked drawer for receiving money should have dual combinations as well. When accessing the safe or locked drawers, two people should also be present.

You Might Also Like: Counting Tips + Refreshers

Dual Controls and Anti-Fraud Measures

Our last tip we’ve mentioned in our Check Signers post – some of the basics for dual controls – but we want to highlight some important ones again. The tips from the Receiving Money section should also be included in anti-fraud measures.

- At least two unrelated people should always be present.

- Counters should count 1-2 times per month. But they should be on a rotation bases so the same people or teams are not handling the funds each week.

- When you are selecting your counting team, they should be chosen based on skill, talents, and gifts; not just on availability. First, develop the ministry description (see the Before the Money section above) then select your team members.

If you are new to anti-fraud measures: start with this blog series

In our post on the Five Barriers to Overcome for Financial Integrity, we explain five barriers – and five advantages – behind financial integrity. Trust us when we say the advantages will outweigh the barriers, every time.

Performing the Offering Count

As we mentioned earlier, MM provides detailed instructions for performing an offering count. These can be found in our training materials, available upon request. With Miller Management new client conversions, we go through a detailed list during our contribution conversion training meeting.

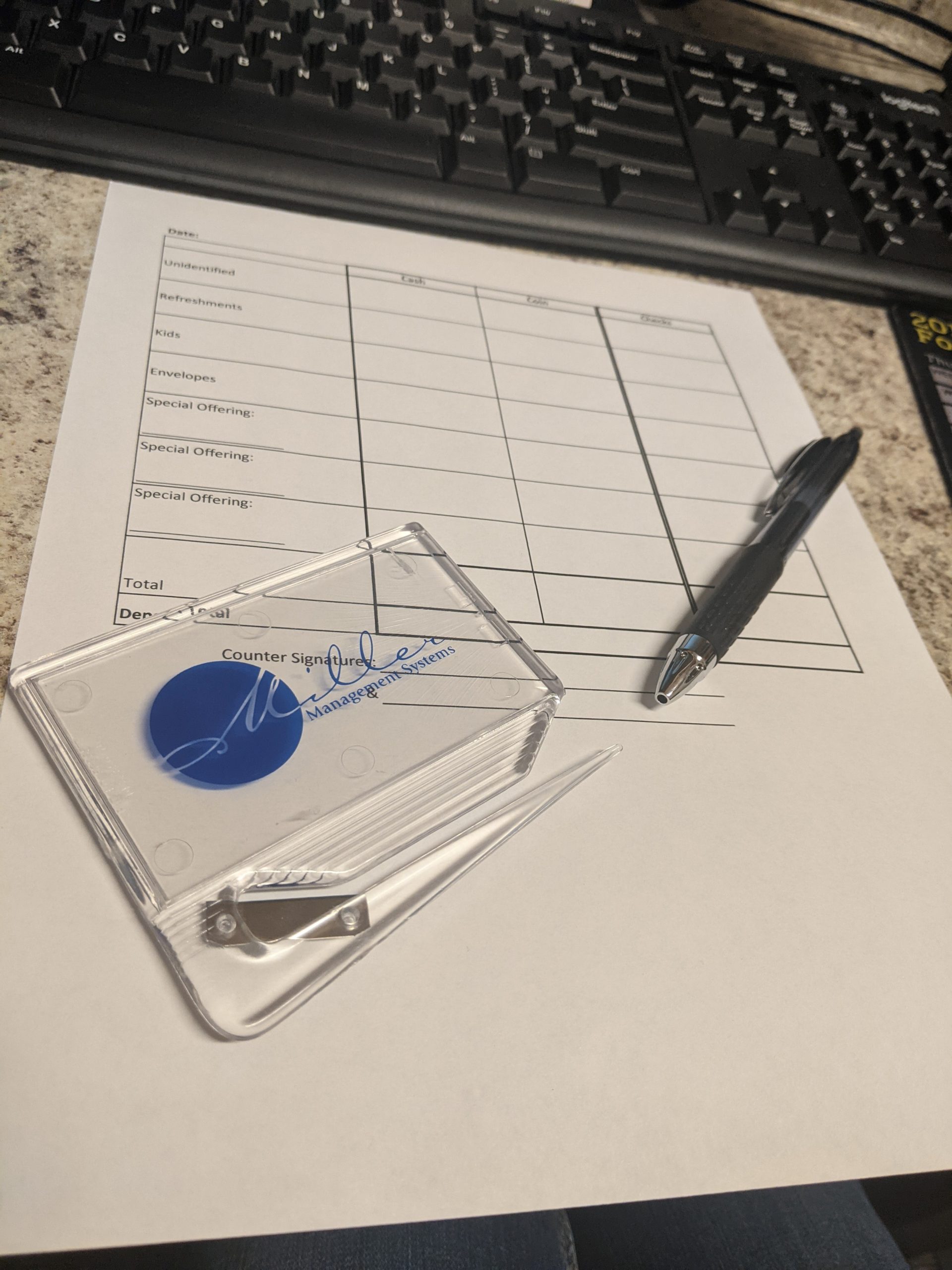

For clients and non-clients alike, we have provided templates on our Resources page to help you perform the offering count, including:

- Deposit Form (for either Church or Nonprofits)

- Cash Counting Sheet

- Loose Cash Log

- Offering Team Confidentiality Agreement

- Ministry Description for Offering Counters

We will leave you with this video of what could happen when proper dual controls are not present. Providing accountability can help even the appearance of any bad intentions from happening.

Stay Connected