May 01, 2018

Anti-Fraud {part 1} – Defining Fraud

Fraud In Ministry

With this fraud case being brought to light, we wanted to share a few of our tips to help prevent fraud in your ministry or organization.

First, let’s define fraud

Actions defined as fraud include but are not limited to:

- Theft of cash, securities, merchandise, equipment, supplies or other assets.

- Unauthorized use of organization employees, property, credit cards, cell phones or other resources.

- Submission of personal or fictitious employee expenses for reimbursement or fictitious or inflated vendor invoices or payroll records for payment.

- Receiving kickbacks or other unauthorized personal benefits from vendors or others.

- Forgery or fraudulent alteration of any check, bank draft, statement, billing, record, form, report, return or other financial document.

- Intentional material misclassification or misrepresentation of revenues, expenses, costs or other data in financial statements, reports, regulatory returns, applications or other communications.

- Intentional failure to disclose material related party transactions, noncompliance with lender requirements or donor/grantor restrictions or other required disclosure matters.

- Intentional improper use or disclosure of confidential donor, client/customer, employee or organization proprietary information.

- Any violation of copyright or licensing laws.

- Any other illegal or unethical activity

Taken from Sample Anti-Fraud Policy, which is available for free download on our Resources page.

Next, what do we do now?

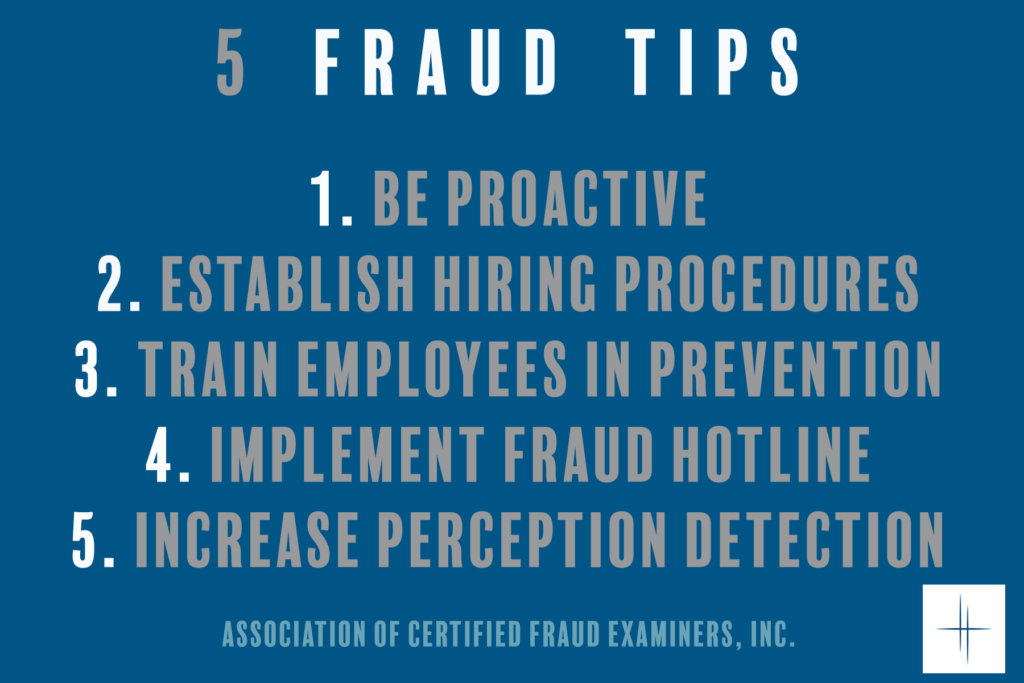

The ACFE, Association of Certified Fraud Examiners, have a few tips:

The ACFE has a large selection of excellent resources in the area of fraud prevention. View their articles, podcasts, videos, training classes, books, and more here.

More examples and helpful information

You can read more about a fraud case that Miller Management actually dealt with in our book, Confessions of a Church Felon – available on Kindle or Paperback on Amazon. This book also has helpful Action Questions at the end of each chapter and is filled with great real-life resources in the Appendix for you to use in your organization now.

“A must-read for any church administration member or those interested in fraud accounting. Confessions of a Church Felon walks the reader through a real life fraud scenario while clearly explaining how to address and prevent church fraud. It offers reflective questions at the end of each chapter to help the reader step back and examine his/her church administration’s practices. I was engaged throughout the book and was left with a better understanding of church fraud and how it can be avoided.” – Amazon Customer Review

Up next, part two of this series – The Fraud Triangle.

Stay Connected