May 12, 2021

Payroll 101 | Starting Payroll in Your Church Plant

Starting Your Payroll

Today, we want to provide a step-by-step guide for setting up payroll for your church plant or ministry. Starting with what you need to do before you begin, making sure the person is classified correctly, some anti-fraud measurers, and rounded out with a deep dive into Ministerial Payroll. Throughout the post, and again at the end, we will provide resources for you to use in your organization to set you up for success.

Miller Management’s Top 6 Steps to Starting Payroll for your Church Plant

Top 6 Steps to Starting Payroll

1. The decision for the type of cooperation may or may not be already decided. If you need help in this area, view this post on setting up a 501c3.

2. Frequency of Pay – decide upon how frequently the paychecks will be provided. We recommend semi-monthly pay periods as it is easier for tax deductions for the organization and budgeting for the employee.

3. Updated Files – this is where a standardized form comes in handy to keep in individual’s Personnel files. We’ve provided a Personnel Action Form on our Resources page to help with that process.

4. Details of Information necessary to process payroll include:

- Date of Hire

- Employee’s Full Name

- Employee’s Social Security Number

- Address

- Direct Deposit Information

- Birthdate

- Wage Information

- Benefit Information

5. Come up with a way to produce payroll checks and payroll taxes. It is very important to make sure the current tax laws and filing schedules are adhered to. Payroll taxes are due with some payrolls – depending on your tax liability – and W-2s are due to individuals each year; along with a W-3 to the IRS. Of course, we will plug our own services here. View our Payroll page for more information.

6. Abide by Federal Wage and Hour Laws. Determine employee classifications of exempt versus non-exempt, and who can qualify for overtime or comp time. Also, document these laws in your human resource policies to keep staff aware and in compliance. Another form you are legally required to have in each personnel file is the individual’s I-9 Form.

Contractor vs. Employee

Now is a great time to understand the distinction of Employees versus Contract Workers. To learn more, you can view this blog post, but here are the most basic definitions:

- If the church or ministry is in charge of hours, pay, and duties; the person is an employee.

- If the worker can dictate their own hours, price, and send another individual to do the job; the person is a contractor.

If the classification is done incorrectly, it creates unnecessary red flags for the IRS. Because the independent contractor will have to pay employer FICA, we don’t see any large tax advantage to try to classify an employee as a contract worker, either. The contractor can claim mileage and some home office expense (maybe) but it just does not amount to enough to place the church at risk.

Employee Classification

The Fair Labor Standards Act requires that employees be paid a fair wage – and in most cases at least minimum wage. The act also applies to the work week hours. Generally speaking, when an employee works over 40 hours, overtime is to be given to the employee. There are exceptions to those rules, and there are three tests to determine if the employee is exempt or non-exempt from them: Salary Level, Salary Basis, and Duties.

Employees are automatically classified as non-exempt unless they meet all three of the following criteria. A base salary level is met; a minimum amount – or their basis – is guaranteed in any work week; and their duties are based upon actual job tasks, not job title. Those duties would be either in Executive, Professional or Administrative job functions.

Overtime does not generally apply to exempt employees, but must be given to non-exempt employees. Comp time can be given to exempt employees and there is not strict rules to those hours given, however; for non-exempt employees comp time can only be taken in the same work week. Any other form of bonuses or extra time off is illegal for non-exempt employees.

Learn more about the Federal Fair Wages Labor Act.

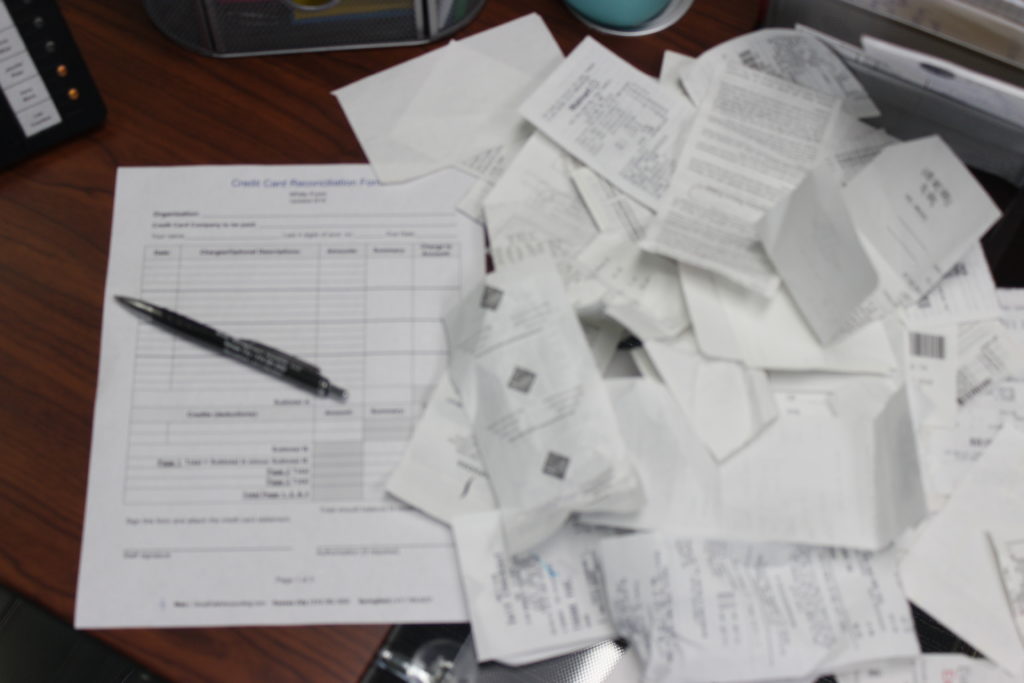

Anti-Fraud

We can’t go too far in this post without reviewing some of the most hot topics of anti-fraud measurers that should be taken in your ministry regarding payroll and ministerial compensation:

- Two unrelated check signors on each check

- Different signor than requestor and check creator

- Always include backup documentation

- All compensation should be documented in their personnel file

- Current forms: W-4, I-9, Housing Allowance. etc. should be kept on file

- Ensure correct and timely filing of all payroll taxes and reports, including quarterly 941s and annual W-3s to the IRS

- Ensure correct delineation of employees vs. contractors

- Distribute timely W-2s and 1099s to employees and contractors

For more information on the differences between Employees and Contractors view our blog and white paper.

Deep Dive into Ministerial Payroll

Non-Ministerial vs. Licensed or Ordained Ministerial payroll differences

Pastors – and usually church staff – need help navigating ministerial tax laws and learning how to best compensate the Pastor of their church. Today, we want to provide some resources in that area.

Dual Status

Ordained or licensed clergy are often misunderstood employment classifications. By IRS mandate, legally ordained and/or licensed clergy are required to be “dual” status tax filers for work performed in the exercise of ministry. This means that clergy are treated as Employees for benefit purposes, and Self-Employed for taxation purposes.

Definition of Ministers, by the IRS:

Ministers are individuals who are duly ordained, commissioned, or licensed by a religious body constituting a church or church denomination. Ministers have the authority to conduct religious worship, perform sacerdotal functions, and administer ordinances or sacraments according to the prescribed tenets and practices of that church or denomination.

If a church or denomination ordains some ministers and licenses or commissions others, anyone licensed or commissioned must be able to perform substantially all the religious functions of an ordained minister to be treated as a minister for social security purposes.

Description of Housing Allowance

What is it? Housing Allowance is a gift from the IRS. It’s an annual amount of compensation that is set aside by the church to cover the cost of housing related expenses for its ministers.

Who qualifies? The primary requirement is for the person to be ordained, commissioned, or a licensed minister. MM recommends, based upon case laws, that a minister meets at least three of the secondary requirements in addition to the primary requirement to safely satisfy the requirement.

How does it work? Each year, the minister estimates the amount of eligible housing expenses to be incurred during the following year. This amount is submitted to the governing body of the church for approval. When paid to the minister the following year, that housing amount is excluded from the taxable federal and state compensation that is reported in box 1 and 16 of the W2. The housing amount is instead reported in box 14 for informational purposes.

Big Takeaway: When you file your taxes, you will have to justify the amount with actual expenses. You are only able to claim the lesser of the two amounts (what you were paid as housing vs. actual expenses) when you file your taxes.

We’ve provided a Housing Allowance Worksheet on our Resources page.

Brief description of S.S.

Social Security is a pay-as-you-go benefit, to receive once you retire. Some Ministers would like the option to opt-out of paying into social security, while some churches ask to cover the social security cost on the minister’s payroll. While both are options, if they are done, there are other things to consider. One being the cost to “cover” the minister’s social security is taxable income, and the other is that there are other benefits you don’t receive if opting out.

From GuideStone:

Few ministers can opt out of Social Security by meeting the strict IRS guidelines required for filing IRS Form 4361, Application for Exemption from Self-Employment Tax for Use by Ministers, Members of Religious Orders and Christian Science Practitioners.

Pastors who choose to opt out of Social Security also lose access to other important benefits, including potential disability payments for themselves and payments to their surviving spouse or dependents in the event of their death. They will also be denied Medicare coverage when they reach age 65, forcing them to provide the entire cost of their health care.

Election by Church To Exclude Its Employees From FICA Coverage

Churches and qualified church-controlled organizations (church organizations) that are opposed for religious reasons to the payment of social security and Medicare taxes may elect to exclude their employees from FICA coverage. If your employer makes this election, it doesn’t pay the employer’s portion of the FICA taxes or withhold from your pay your portion of the FICA taxes. Instead, your wages are subject to SECA and you must pay SE tax on your wages if they exceed $108.28 during the tax year. However, you can request an exemption from SE tax if you are a member of a recognized religious sect, as discussed below.

Churches and church organizations make this election by filing two copies of Form 8274. For more information about making this election, see Form 8274.

Election by Certain Church Employees Who Are Opposed to Social Security and Medicare

You may be able to choose to be exempt from social security and Medicare taxes, including the SE tax, if you are a member of a recognized religious sect or division and work for a church (or church-controlled nonprofit division) that doesn’t pay the employer’s part of the social security tax on wages. This exemption doesn’t apply to your service, if any, as a minister of a church or as a member of a religious order.

Make this choice by filing Form 4029. See Requesting Exemption—Form 4029 , later, under Members of Recognized Religious Sects.

U.S. Citizens and Resident and Nonresident Aliens

To be covered under the SE tax provisions (SECA), individuals must generally be citizens or resident aliens of the United States. Nonresident aliens aren’t covered under SECA unless a social security agreement in effect between the United States and the foreign country determines that they are covered under the U.S. social security system.

To determine your alien status, see Pub. 519, U.S. Tax Guide for Aliens.

Paying Ministers

The short answer is that pastor’s compensation should be viewed as a biblical imperative and we should exercise grace and generosity as we construct the package. We also believe in accountability and there are some “earthly” criteria that may help create the appropriate Ministerial Compensation Package.

We recommend that the basis for a pastor’s compensation package should begin by evaluating, to the best extent possible, the candidates three “E’s”:

- Education – the higher the level of professional education and preparation, the higher the package. We strongly recommend checking credentials, and placing more weight on accredited degrees and accredited educational institutions.

- Experience – the more relevant experience, the higher the package. Be sure and double check the experience listed to ensure accuracy.

- Expertise – defined here as the level of proven skills and competencies. The higher level of proven success, the higher the package. Once again, double check information for accuracy.

One token to leave you with for compensating Pastors is to remember to be consistent and bless with grace and generosity.

Other Benefits

Now let’s consider some extras: cell phones, car allowance, books, discretionary funds, meals, & entertainment. It may seem easier to lump all of these extras into the overall base salary and just let minister figure it out for themselves; but we know that really isn’t a fair wage, and most of those items shouldn’t be located in taxable income categories.

Just like for every other employee, if a legitimate expense is incurred, receipts and a request for reimbursement should be submitted and charged to the correct budget account. This keeps the amounts legally out of compensation, thus reducing confusion and potential tax burden.

Retirement Savings Arrangements

Retirement savings arrangements are plans that offer you a tax-favored way to save for your retirement. You can generally deduct your contributions to the plan. Your contributions and the earnings on them generally aren’t taxed until they are distributed. To set up one of the following plans you must be self-employed.

Retirement plans for the self-employed.

- SEP (simplified employee pension) plan.

- SIMPLE (savings incentive match plan for employees) plan.

- Qualified retirement plan (also called a Keogh or H.R. 10 plan), including a 401(k) plan.

Other Forms & Resources:

Each instance of Ministerial Payroll can be unique. We recommend using a qualified tax accountant who is familiar with these types of cases to make sure you are following all IRS laws.

Below are some other resources – most we mentioned already – to help you find your next step.

Miller Management Resources:

- Ministerial Checklist

- Personnel Action Notice

- Hiring 101

- Employee vs Contractor

- Ministerial Housing

- Ministerial Compensation Package

- Check Signors

Other Resources on the web:

- Tax Withholding Estimator from the IRS

- IRS Publication 517

- Federal Labor Standards Act

- Church Law & Tax Webinar re: Church Compensation

Stay Connected