November 11, 2021

Accounting Day & Fraud Awareness

We don’t think it’s any coincidence that International Accounting Day (November 10th) and #FraudWeek (November 18th – 22nd) are only days apart from each other this year. Accounting Day is a time to honor those special people gifted with logical brains. Whereas Fraud Awareness Week is a time for those same brainy people to remind us how to keep our money safe.

The History of Accounting:

For a lesson in the history of Accounting, and how it came to America, visit Investopedia’s article where they talk about the origins of bartering and the importance of the Railroad to the evolution of Accounting.

If you’d rather watch a video instead of read, we found this video from the The Finance Storyteller. He walks you through how different eras needed accounting in different ways.

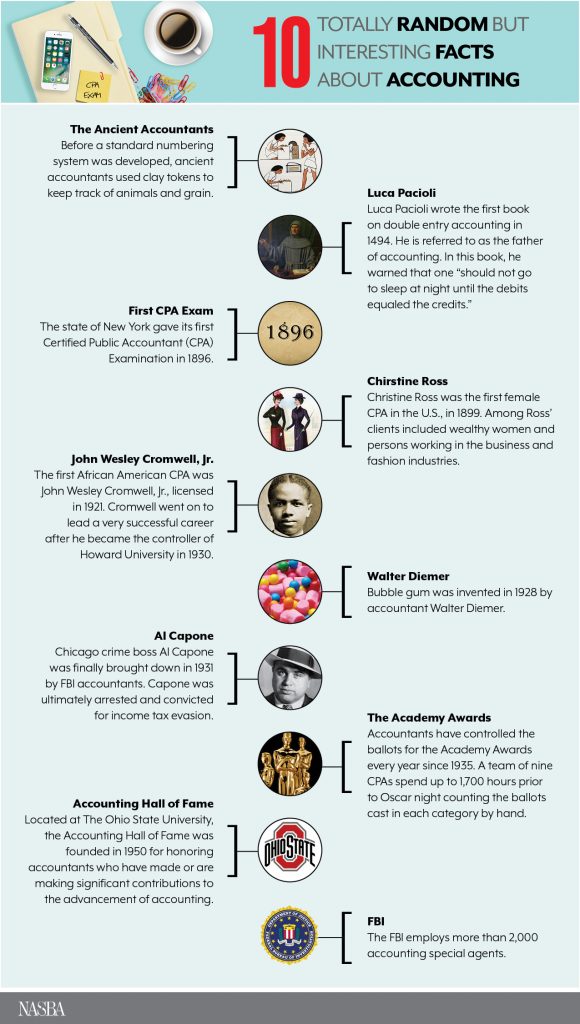

Lastly, we have a history of Accounting infographic from NASBA.

Fraud Awareness Week:

“International Fraud Awareness Week, or Fraud Week, was established by the Association of Certified Fraud Examiners (ACFE) in 2000 as a dedicated time to raise awareness about fraud. The week-long campaign encourages business leaders and employees to proactively take steps to minimize the impact of fraud by promoting anti-fraud awareness and education.” Source: fraudweek.com

You know your accounting partners here at Miller Management are actively helping you each week reduce your opportunities and risks of fraud, so we are always excited for this week. And if you are already a client, you will know these next tips by heart. But for those who want a refresher, see our list of action items below.

What you can do:

Some simple steps you can do in your organization right now include:

- have two check signers sign all paychecks and reimbursements

- rotate counting committee members for your offering counting

- rotate check signors, but try to have one consistent signer (looking for trends)

- have people as the correct status (employee vs. contractor)

- turn in all receipts (and have someone sign off before) before being reimbursed

Outsourcing

Accountability and Awareness are two areas that outsourcing companies can help with. Those are also a couple of the main reasons Miller Management exists. We partner with you to help make finances more clear and give you confidence in your fiancial decisions and practices.

Read more about Accountability in our Outsourcing series

Fraud Prevention Resources

Above are a few ideas you can start doing today, but for more resources, we suggest the following:

- See our previous Fraud Week post for even more ideas and resources.

- Check out our Anti-Fraud series for how to set up measurers to prevent fraud in your ministry.

- If you suspect there may be fraudulent activity inside your organization, speak to a MM representative and they can direct you where to go next.

- If you suspect fraudulent activity is happening outside of your organization, report that directly to your credit card company. Read this list from the FBI about how to avoid credit card fraud.

- Come across any email scams that might have fraudulent intent? Make sure to forward those to your local government.

Now go forth and be fraud aware. Happy Fraud Week!

Stay Connected